August Recap and September Outlook

An extremely low jobs report for August, released in the first week of September, focused all attention on the jobs market. The real shock wasn’t the low number of jobs created, it was the revisions to prior months that resulted in a negative 13,000 jobs in June. This marked the first contraction of the labor market since December 2020. With the unemployment rate now at 4.3%, the highest since 2021, it’s clear that while we been having record-breaking summer heat, the labor market has been in entering a deep freeze.

Chairman Powell, in recent speeches, had already been clear that a rate cut was coming at the Fed’s September meeting. Now the discussion is whether it will be a 25 basis point cut, or a “catch up” of 50 basis points. It also opens the door to additional cuts in 2025.

Inflation data for August will be very closely watched. Chairman Powell has clearly shifted to a need to prioritize the Fed’s goal of full employment, over keeping inflation at around 2%.

Let’s get into the data:

- Inflation, as measured by CPI, rose less than expected. For the 12 months ended in July, CPI was 2.7%. The monthly number rose 0.2%.

- Non-farm payrolls for August came in at 22,000. The U.S. Bureau of Labor Statistics reported that the labor market added significantly fewer jobs than the low prediction of 75,000 that were expected.

- Manufacturing isn’t adding jobs. This sector of the market has 78,000 fewer jobs compared to a year ago.CME FedWatch is projecting a lower 2025 target rate. Investors are pricing in cuts down to 3.5% to 3.75%, 75 basis points lower than the current target range, according to 30-day Fed Funds futures.

What Does the Data Add Up To?

The goal of lower rates is to make money more available, which increases spending by companies and consumers. This feeds into more hiring and higher prices for assets. For investors, that’s good news. Equity markets initially appear to be reacting largely positively, despite the fear of higher inflation. With just a few months to go in 2025, economists and other market participants are beginning to sketch out a potential projected framework for 2026.

Correctly identifying what phase of the business cycle the economy is in is a big part of this. If we are in an early growth cycle, based on lower rates and stable inflation, projections for 2026 could be rosy. This would spur confidence in the business sector for hiring and capital investments, and make consumers feel richer, so they spend more.

There are some early straws in the wind. Areas of the market that are particularly sensitive to interest rates, such as small cap and homebuilders stocks, are rallying to record heights. Consumer confidence can be seen in positive momentum for consumer discretionary and retail stocks.

Economists also try to describe the shape of the economic recovery. There appear to be two dominant themes here: The Nike “Swoosh” economy and the K-shaped economy. The Swoosh is downturn followed by a slow, gradual upturn. This is the more positive viewpoint. The K shape refers to a bi-furcated economy in which one section or demographic does well, indicated by the upward sloping upper arm of the K, and another demographic struggles deeply. The fear is that higher asset prices will benefit wealthier sections of the economy, and this will mask the difficulties being experienced by the middle and lower classes, which are actually dragging the entire economy down.

The bond market may tell a different story. The price of bonds performs inversely to their yields. A sell-off in Treasury bonds would have the effect of driving up yields, particularly on the long end. This would result in higher mortgage costs and other consumer-facing interest rates.

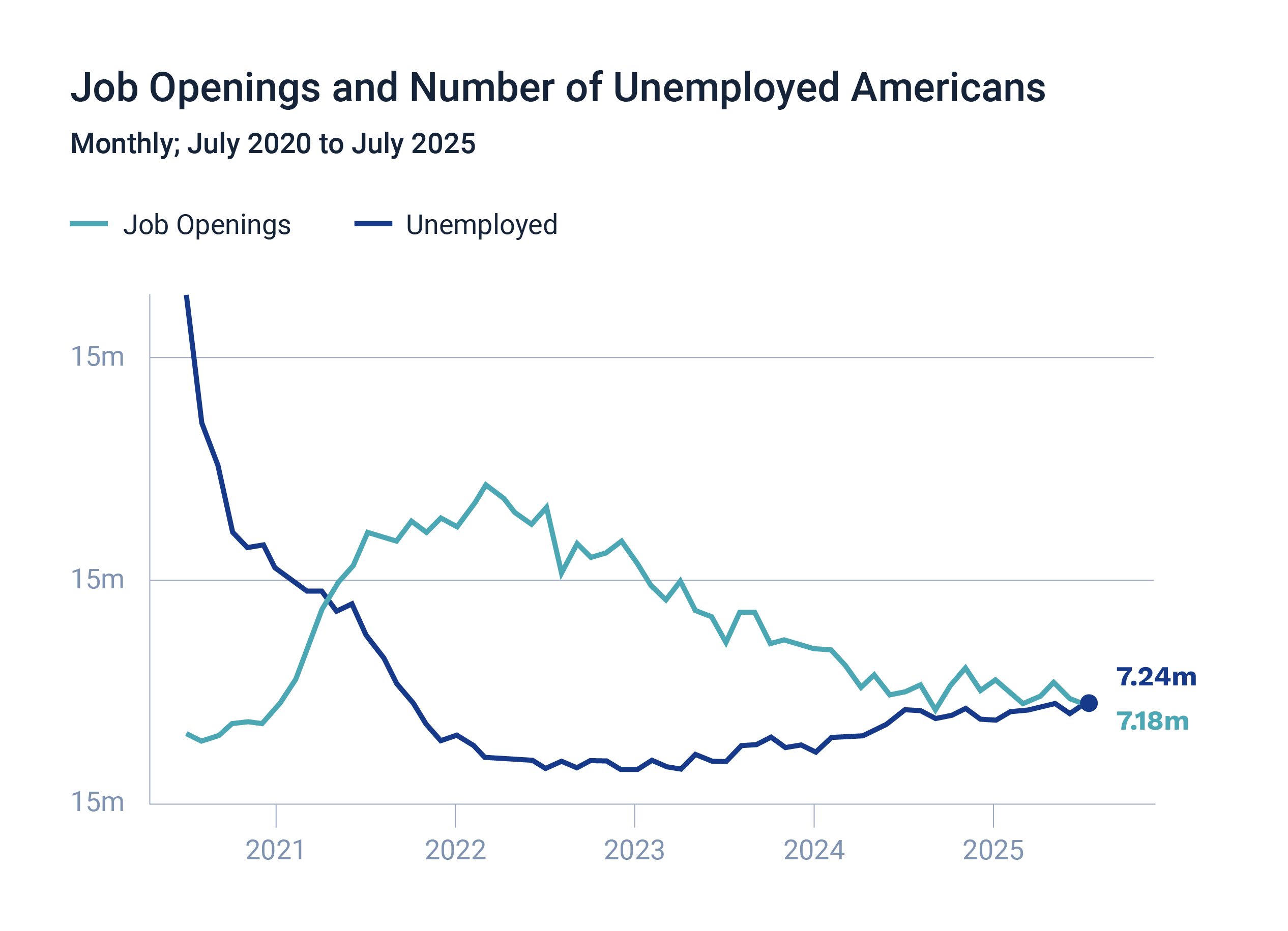

Chart of the Month: Labor Freezes Up

Labor market growth went from an orderly slowdown to an abrupt halt as the July data was reinforced by worse August data and deep revisions. For the first time since 2021, the number of unemployed Americans is greater than the number of open jobs.

Source: Bureau of Economic Analysis (data) Axios (visual)

Equity Markets in August

- The S&P 500 was up 1.91% for the month

- The Dow Jones Industrial Average gained 3.20% for the month

- The S&P MidCap 400 rose 3.26% for the month

- The S&P SmallCap 600 increased 6.89% for the month

Source: S&P Global. All performance as of August 31, 2025.

Nine of the eleven S&P 500 sectors had positive returns, with Materials up 5.59%, taking the lead from Information Technology, which has led for the last several months. Utilities were in last place, down 2.03%. Earnings continued to come in stronger than expected and are likely to post a record level for Q2. Breadth increased over the month, back to the levels we saw in May and June, with 337 issues up and 168 down. The market notched five record closing highs.

Bond Markets in August

The 10-year U.S. Treasury ended the month at a yield of 4.23%, up from 4.36% the prior month. The 30-year U.S. Treasury ended August at 4.94%, up from 4.89%. The Bloomberg U.S. Aggregate Bond Index returned 0.38%. The Bloomberg Municipal Bond Index returned 0.47%.

The Smart Investor

Interest rate cuts are clearly here, but there is still no definitive direction for the economy. Tariffs remain in flux, with the Trump administration likely to appeal to the Supreme Court. Uncertainty is still the watchword, even as equity markets respond positively to the long-awaited resumption of rate cuts.

As we enter the last quarter of the year, the focus should be on good housekeeping. Preparing for tax season by rebalancing portfolios and taking advantage of tax-loss harvesting and maxing out 401k contributions. If you are 60, 61, 62, or 63 in 2025, you are eligible for an expanded catch-up contribution limit, to 11,500 from 7,500.

The end of the year is also time to look at your charitable giving plans, and make sure you have met your goals. There are a lot of tax advantages to charitable giving, but the core is to set up a plan that reflects what is important to you and your family.

The Big Beautiful Bill made estate planning more certain, so if you’ve been holding off putting a plan in place, now is the time.

Taking a careful look now and then planning for year-end can help you implement a tax strategy that keeps you on track for your wealth goals.

This work is powered by Advisor I/O under the Terms of Service and may be a derivative of the original.

The information contained herein is intended to be used for educational purposes only and is not exhaustive. Diversification and/or any strategy that may be discussed does not guarantee against investment losses but are intended to help manage risk and return. If applicable, historical discussions and/or opinions are not predictive of future events. The content is presented in good faith and has been drawn from sources believed to be reliable. The content is not intended to be legal, tax or financial advice. Please consult a legal, tax or financial professional for information specific to your individual situation.

This content not reviewed by FINRA

Stay In Touch