October Recap and November Outlook

The fourth quarter has seen the longest government shut down on record, and an election cycle that would seem to reflect some voter dissatisfaction with the status quo.

The shutdown has paused official government data sources, but the economy appears to be holding up just fine, and even if consumer sentiment is understandably a bit under water, anecdotal evidence provided by brands would seem to indicate that consumers are still spending.

The Federal reserve met at the end of October and cut the key Fed funds rate to a range of 3.75%-4%, but did provided guidance that a further rate cut in December is by no means ensured.

Let’s get into the data:

- The shutdown again meant no government labor statistics. The Chicago Fed’s estimate of the unemployment rate, which combines public-sector with private-sector data, rose to 4.36% in October, from 4.23% in August.

- Looking only at private-sector employment, ADP reports a gain of 42,000 jobs in October. This marks a rebound to growth, after two months of contracting labor market data.

- The University of Michigan Consumer Sentiment Index declined by 3 percentage points in November. It is now at its lowest level since 2022.

- The Atlanta Fed’s GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2025 is 4.0 percent.

What Does the Data Add Up To?

After largely ignoring the shutdown, the escalation of canceled flights at a long list of airlines throughout the country may put pressure on Congress to work out a solution.

So far, the lack of government data has not roiled markets as much as anticipated, and there seems to be continued confidence in the markets and in the economy.

The picture with the Federal Reserve has gotten more complicated. The Fed Funds rate is a bellwether of the economy because it is a benchmark for both commercial and consumer interest rates. It sets the rate banks pay for overnight lending, and it impacts the prime rate, which in turn sets the level for mortgages, credit cards and auto loans. Having a loose monetary policy in which it’s easier for businesses to access funds for expansion, and for consumers to carry debt, keeps our economy expanding.

Rate cuts have been anticipated all year, as inflation began to achieve normal levels and the labor market continued to remain solid. The uncertainty of tariffs and now the government shutdown has created revisions to the expected path of interest rates. Fed Chairman Powell was very clear that a further cut in December may not be on the cards.

Despite all this, the equity markets have turned in mostly solid performance, with momentum leading investments themes, as corporate tax incentives and individual tax refunds resulting from the Big, Beautiful Bill support corporate earnings and consumer spending.

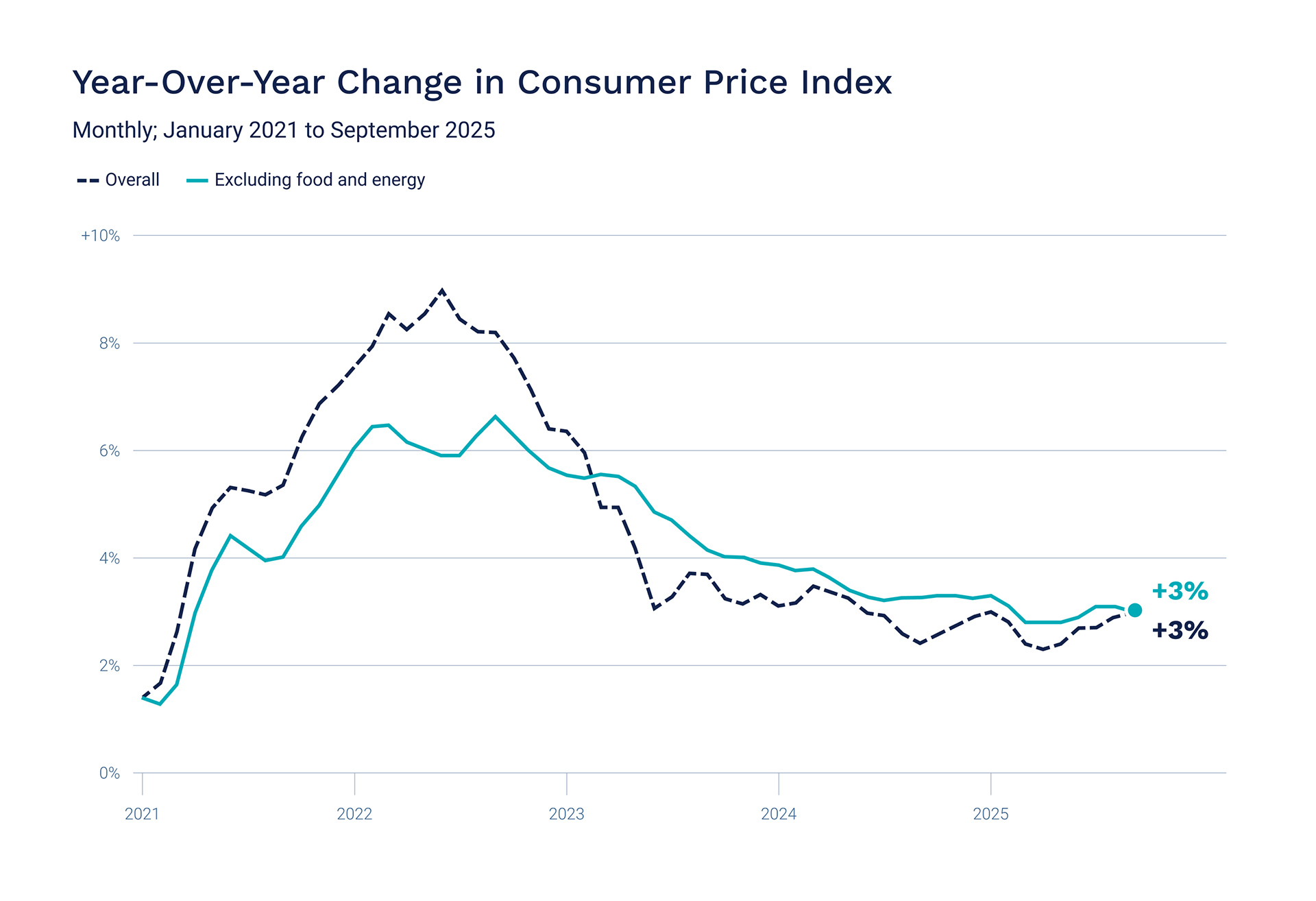

Chart of the Month: Inflation is holding steady

Source: Axios

Equity Markets in October

- The S&P 500 was up 2.27%% for the month

- The Dow Jones Industrial Average gained 2.51% for the month

- The S&P MidCap 400 fell 0.53% for the month

- The S&P SmallCap 600 decreased 0.95% for the month

Source: S&P Global. All performance as of October 31, 2025.

Six of the eleven S&P 500 sectors had positive returns. Five of the Magnificent Seven gained, with Meta and Microsoft declining. Volatility increased to 1.00%, from 0.69% in September. In October, 4 of the 23 trading days moved at least 1%, compared to none in September.

Bond Markets in September

The 10-year U.S. Treasury ended the month at a yield of 4.09%, down from 4.16% the prior month. The 30-year U.S. Treasury ended October at 4.66%, down from 4.74%. The Bloomberg U.S. Aggregate Bond Index returned 0.38%. The Bloomberg Municipal Bond Index returned 1.10%.

The Smart Investor

November is a great time to take stock of your plan and your goals, and make sure you are proactively keeping yourself on track. If you are age 60, 61, 62, or 63, you can now add significantly more to your catch-up contributions for your tax-advantaged retirement plan. You are now entitled to a “super catch-up” provision beyond the $7,500 standard catch-up. You can contribute up to $3,750, for a total of $11,250.

Starting in 2026, catch-up contributions will have an income threshold above which they will need to be made in a Roth account, so taking advantage of the boost now can be worthwhile. If you’re not eligible for the catch up contribution, maximizing your regular contribution will ensure you get a company match if you are eligible, and will bring you the most tax advantages.

Thinking through your charitable contributions and overall giving strategy so you can make the right moves before year end is a nice exercise for the holiday season.

Markets have been volatile, so looking over your winners and losers and engaging a tax-loss harvesting strategy before year end can also help with your tax picture.

Taking a careful look now and then planning for year-end can help you implement a tax strategy that keeps you on track for your wealth goals.

This work is powered by Advisor I/O under the Terms of Service and may be a derivative of the original.

The information contained herein is intended to be used for educational purposes only and is not exhaustive. Diversification and/or any strategy that may be discussed does not guarantee against investment losses but are intended to help manage risk and return. If applicable, historical discussions and/or opinions are not predictive of future events. The content is presented in good faith and has been drawn from sources believed to be reliable. The content is not intended to be legal, tax or financial advice. Please consult a legal, tax or financial professional for information specific to your individual situation.

This content not reviewed by FINRA

Stay In Touch